We analyzed GM versus Ford Motor Company (F) when we heard that Berkshire Hathaway (BRK.A and BRK.B) bought 10 million shares. Even though it represented 0.3% of Berkshire's public equity holdings and we presume it was probably the idea of Berkshire's new portfolio managers Weschler and Combs we decided to compare General Motors (GM) versus Ford Motor Company (F). We were blown away at the interest our initial analysis report generated and have decided to expand further our analysis and evaluation on Berkshire's GM investment and Ford versus GM.

In our follow-up article in which we analyzed, compared and evaluated Ford (F) versus General Motors (GM) we analyzed five important items of interest when investing in automakers:

- Automotive industry environment factors

- Debt Capital used by F and GM and by F's and GM's automotive and financial segments

- Company liquidity

- Pensions and other post-retirement benefits

- Equity Capital Position of Ford and GM

We concluded that Ford Motor performs better than GM on each of these metrics. In this installment in our analysis and evaluation of Ford versus GM we will examine the following items of interest here:

- Finance Subsidiaries

- Balance Sheet and management of business assets

- Dominant shareholders of Ford and General Motors.

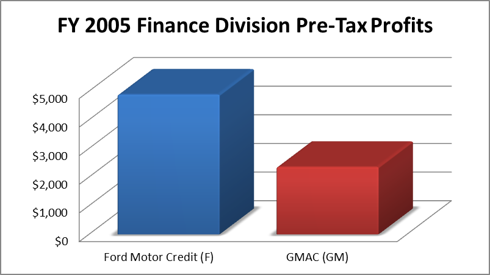

Ford Motor Credit versus GM Financial: General Motors had a 40 year head start versus Ford and Chrysler in the automotive finance sector. GM founded General Motors Acceptance Corporation to enable customers to finance their automobile purchases from General Motors. The year before Ford Motor Credit was established (1959), GMAC had financed its 40 millionth automobile. GMAC had also added a mortgage financing business in 1985 and a commercial finance business in 1999. Other businesses that GMAC was involved in included insurance and online banking. Before GM and Ford began to see severe profit declines in 2005, both companies could count on the finance divisions to offset losses in each company's automotive manufacturing division. Despite the fact that GMAC had 50% more revenues than Ford Motor Credit in 2005, Ford Motor Credit's pre-tax profits were 107% higher than GMAC's in 2005.

Source: 2005 Annual Reports: Ford and GM, Amounts in $Ms

In 2006, GM sold a 51% stake in GMAC to Cerberus in order to shore up GM's Balance sheet in the wake of a $10.4B loss. Ford held on to Ford Motor Credit and mortgaged the entire company in order to raise $23.5B in order to complete its turnaround. After GM and GMAC emerged from bankruptcy during the crisis, its stake in GMAC was diluted from 49% to 4% and its estate (Motors Liquidation) held 6% of GMAC. GMAC changed its name to Ally Financial and GM bought AmeriCredit (Now known as General Motors Financial Company) to finance automobiles bought by sub-prime customers. Ford Motor Credit was profitable every year except 2008 and snapped back into the black in 2009 with a $1.8B segment profit. We see here that Ford is miles ahead of GM in automotive finance, though we believe that GM will want to reacquire Ally's banking and automotive lending operations at some point. The US Government owns 73% of Ally and we see GM combing GM Financial with Ally.

Balance Sheet and management of business assets: We already analyzed Ford's liquidity, debt and equity position versus GM and we concluded that Ford scores better on those metrics than GM. Now, we are going to analyze the balance sheets of Ford and GM. We can see that Ford outshines General Motors on three important balance sheet metrics, including two working capital metrics. The areas where Ford's balance sheet outshines GM's are as follows:

- Deferred Tax Assets: Ford not only has more operating loss carryover assets than GM, but Ford began cashing those assets in during Q1 2012. Ford has over $14.5B in deferred tax assets primarily due to operating loss carryovers, GM has $5.4B.

- Accounts Receivable Turnover: Ford operates with less than half the account receivable levels that GM operates with and had a higher automotive segment receivables turnover ratio in 2011 (31.2) than GM (15.97)

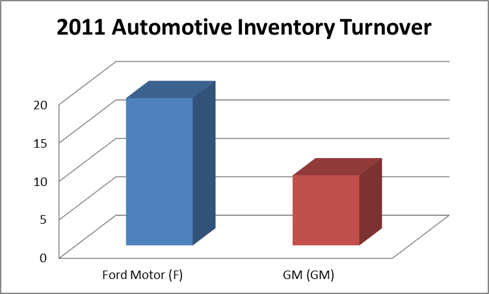

- Inventory Turnover: Ford operates with half the inventory levels of GM and had a higher automotive segment inventory turnover ratio in 2011 (19.2) than GM (9.1)

Source: 2011 10-K Reports from Ford and General Motors

Source: 2011 10-K Reports from Ford and General Motors

Influential Shareholders: GM's four most influential shareholders are the US Treasury (30%), the Canadian Government (8.4%), the United Auto Workers (12.3%) and Motors Liquidation Trust (Old GM) (5.2%). In contrast, the Ford Family controls 40% of Ford's voting rights through its Class B super-voting stock holdings even though the Ford Family has maybe 1% of the economic interest. On one hand, we prefer no super-majority voting shares in any company. However, we find that even with this handicap, Ford is a better investment versus GM. Ford has one united family as its dominant shareholder. GM has two federal governments, an industrial labor union and a bankruptcy trust who are its influential shareholders. We believe that one private family has a greater likelihood of setting a unified corporate goal and achieving it than two federal governments, a bankruptcy trust and an industrial labor union, as GM's shareholders represent four very different constituencies, which may sometimes have differing and conflicting interests. In our professional opinion, there is one good thing about the supermajority voting rights of the Ford Family in Ford Motor Company. In his outstanding, timeless classic autobiography Iacocca, Lee Iacocca said with regards to the Ford Family that the Ford Family has always had the mentality as "the Fords against the world". We believe that mentality may have resulted in the company being the perpetual also-ran to General Motors in the auto industry, losing market share to the Japanese and its purge of Iacocca and his lieutenants like Hal Sperlich. However, we also believe that this mentality enabled Ford to stave off bankruptcy, unlike General Motors and Chrysler and do it without relying on the government to bail out Ford Motor Company.

Based on the original 11 reasons we articulated in our initial analysis, and with the four additional factors we analyzed and evaluated in our follow-up plus the three metrics we analyzed today, we believe that if investors want to follow Berkshire Hathaway into the automotive sector, we recommend investors buy Ford Motor instead of Government Motors. We would rather be invested in a completely private, family influenced business rather than a product of government-sponsored crony-capitalism. We will be following up this analysis by researching and analyzing further as to why Ford survived on its own and GM could not.

Disclosure: I am long BRK.B.

Additional disclosure: Saibus Research has not received compensation directly or indirectly for expressing the recommendation in this report. Under no circumstances must this report be considered an offer to buy, sell, subscribe for or trade securities or other instruments.

annie zuccotti park leymah gbowee ows kindle fire review community matt schaub

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.